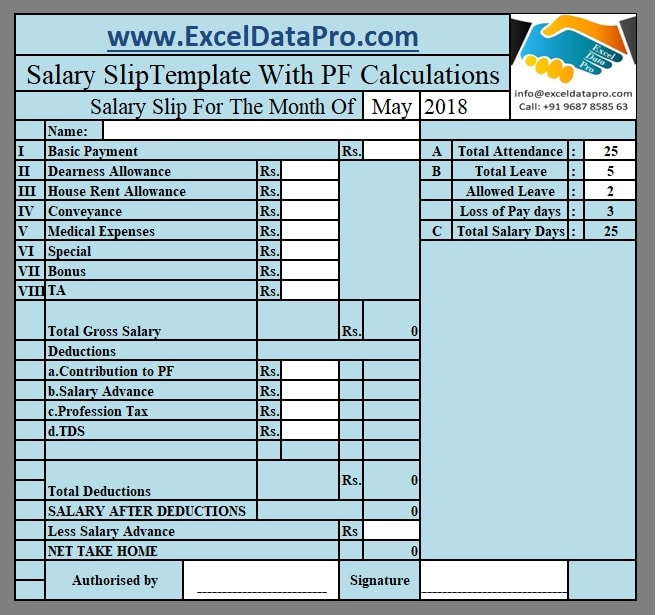

Again, check the laws for your location to see what documentation is required and how/when you are required to provide it to your employees. You can then provide your employees with a printed and/or digital payslip. pdf as the file type.Īfter learning the legal requirements for your business payslip, adapt this template to match. You can create a PDF of the Payslip worksheet in Excel by going to File > Save As and selecting. If payments are made electronically via ACH (Direct Deposit), then you may want to send the payslip via email as a PDF (if that is acceptable according to local laws). Note: This spreadsheet does not calculate taxes or other deductions automatically.

The hours and amounts should update automatically (using lookup formulas).

To make the YearToDate worksheet more concise, you can hide the columns that you aren't using.

Then, you select the Pay Date in the Payslip worksheet to update the amounts in the Payslip. Instead of entering amounts directly into the Payslip, you will update the YearToDate worksheet with the hours, rates, and payment amounts.

So, we highly recommended that you contact a professional accountant to advise you on those requirements and to learn what categories of earnings and deductions you should be using. Important ! Your country or location may have different payslip and pay stub requirements.

0 kommentar(er)

0 kommentar(er)